How To Pick The Right Mutual Fund

Choosing the right mutual fund can feel like a daunting task, especially with the vast number of options available today. Whether you're saving for retirement, a child's education, or any other long-term goal, picking the right mutual fund is key to making your investment strategy successful. This article will guide you through the essential factors you should consider when selecting a mutual fund, ensuring you can make an informed decision that suits your financial goals, risk tolerance, and time horizon.

Understand Your Investment Goals

The first step in choosing the right mutual fund is to understand your investment goals. Are you looking to grow your wealth over the long term, generate steady income, or preserve your capital? Your goals will influence the type of mutual fund you should select.

For instance, if you aim to grow your wealth over time, equity funds (which invest in stocks) might be a good choice. They have higher potential returns, but they also come with higher risk. On the other hand, if you are more focused on preserving your capital while earning some income, bond funds or money market funds may be more suitable. These funds are generally less volatile, though their returns tend to be lower.

Assess Your Risk Tolerance

Once you have a clear understanding of your investment goals, the next step is to assess your risk tolerance. Risk tolerance refers to how much risk you are willing to take with your investments. Different mutual funds come with varying degrees of risk, and it's important to select one that aligns with your comfort level.

If you are risk-averse, you might lean towards funds that invest in safer assets like government bonds or blue-chip stocks. Conversely, if you're willing to take on more risk for the potential of higher returns, you could consider more aggressive equity funds that invest in smaller companies or emerging markets.

Evaluate The Fund’s Past Performance

While past performance is not always indicative of future results, it can give you some insight into how well a fund has performed in various market conditions. Reviewing the fund’s historical returns helps you understand how it reacts to market volatility and whether it aligns with your investment goals.

When evaluating past performance, it's important to look at the fund’s performance over a longer time horizon, such as 3, 5, or even 10 years, rather than focusing on short-term results. This provides a more accurate picture of how the fund has weathered different market cycles, including periods of economic downturn.

Consider The Fund’s Fees

One of the most overlooked aspects of selecting a mutual fund is understanding its fees. Fees can significantly impact your returns over time, and some funds charge more than others. It's important to understand the fee structure of the mutual funds you're considering to ensure they align with your budget and long-term goals.

There are several types of fees you should be aware of. These include the expense ratio, front-end loads, back-end loads, and other management fees. The expense ratio is the annual fee that covers the fund’s operating costs, and it's expressed as a percentage of the fund's assets. A higher expense ratio can eat into your returns, so look for funds with a lower expense ratio whenever possible.

Additionally, some funds charge sales loads (or commissions) when you buy or sell shares. Front-end loads are charged when you purchase shares, while back-end loads apply when you sell. There are also no-load funds, which don’t charge any sales commission. Choosing no-load funds can help reduce the cost of your investment.

Diversify Your Portfolio

Another key consideration when picking the right mutual fund is how it fits within your overall portfolio. Diversification is the practice of spreading your investments across different asset classes (stocks, bonds, real estate, etc.) to reduce risk. By diversifying your portfolio, you ensure that your entire investment is not tied to the performance of one particular sector or market.

Consider how the mutual fund you’re interested in will complement your existing investments. If your portfolio already has significant exposure to stocks, for instance, you may want to choose a fund that invests in bonds to balance out the risk. Similarly, if you have a lot of exposure to domestic stocks, you might want to diversify by investing in international funds to broaden your geographical exposure.

Look At The Fund’s Asset Allocation

Each mutual fund has a specific asset allocation strategy, which dictates how the fund’s assets are divided among different types of investments, such as stocks, bonds, and cash. The asset allocation determines the fund’s risk level and potential for return.

For instance, a fund with a high allocation to stocks is likely to be more volatile, but it also has greater potential for high returns. A fund with a larger portion in bonds or cash will likely be more stable, but its returns will tend to be lower. Understanding the asset allocation of the mutual fund you’re considering will help you determine whether it aligns with your investment goals and risk tolerance.

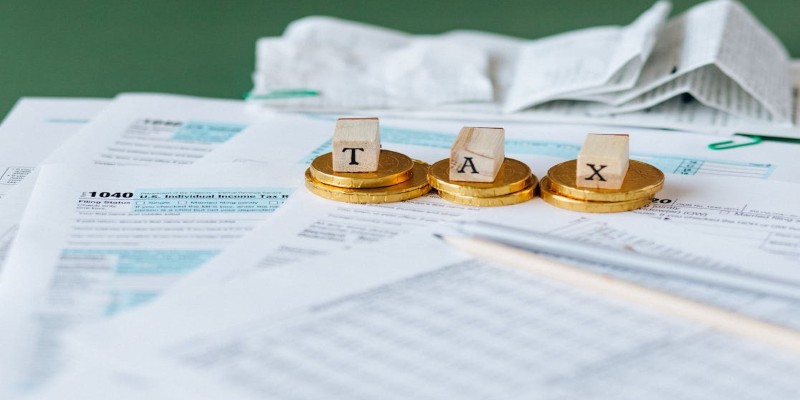

Be Mindful Of Tax Implications

Taxes can have a significant impact on your investment returns, and mutual funds are no exception. When you invest in a mutual fund, you may be subject to taxes on dividends, capital gains, and interest income generated by the fund. Understanding the tax implications of your investment is essential to ensure you’re not losing more money than necessary.

For instance, funds that primarily invest in stocks may generate long-term capital gains, which are taxed at a lower rate than short-term gains or interest income. On the other hand, bond funds may generate income that is subject to higher tax rates. You may also want to consider tax-efficient funds that focus on minimizing tax liability by using tax-advantaged strategies.

Conclusion

Picking the right mutual fund is a critical step in building a successful investment portfolio. By understanding your investment goals, assessing your risk tolerance, reviewing the fund’s past performance, and considering factors like fees, management, and asset allocation, you can make an informed choice that aligns with your financial objectives. Whether you’re new to investing or have years of experience, making the right mutual fund choice can significantly impact your financial future.